I received a subscription to the MoneyTime program for review purposes and was compensated for providing my opinions in this post. All opinions expressed are my own.

I think most parents can agree with me when I say that all kids should be taught Financial Literacy in school (or at home if you homeschool.) But many schools do not include an in depth financial literacy class that is required for all students, and many parents, having never had such a class, also don't feel equipped to teach their kids more than just the basics.

I am one of those in the later group. I understand the basics of money and then some, but I am definitely not prepared to teach my kids all the technical information involved with taxes, mortgages, and investing.

Lucky for me and all you other parents who's heads start spinning when it comes to interest rates and stock prices. All the numbers!!! Now you can introduce kids ages 10-14 years-old to all of these concepts and more with the MoneyTime Financial Literacy Program.

Benefits of using MoneyTime to Teach Kids about Money

- Teaches financial literacy beyond spending, saving, and budgeting.

- Requires NO financial knowledge

- Includes suggested activities for further study

- Online

- Fits easily into your schedule

- Game format including rewards for good performance

- Personalized experience

At the pre-teen and early teen ages, most parents focus on teaching kids about spending vs. saving as well as budgeting. These are great things to teach at an early age, but kids can and need to learn more, so they can make more informed choices when they go out and get a job. How many 16-year-olds choose not to invest because they see what they thing they need now as more important? It happens a lot. I know, I've been there.

MoneyTime Financial Literacy program teaches about needs vs wants as well as some investment opportunities.

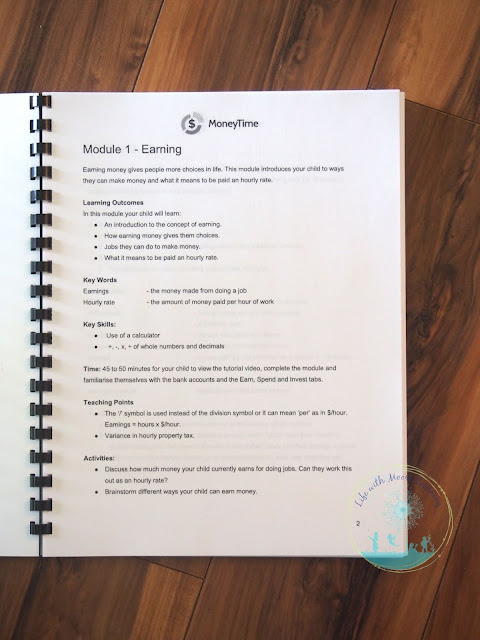

While MoneyTime does have more in depth coverage of financial topics, they do not require you to have any prior knowledge at all. The modules take kids step-by-step through the information, and there are also several modules for you to work through with your child, but again, the information is step-by-step and easy to follow.

Along with the parent/ child modules, a parent study guide is also provided in the form of a PDF. I printed it for easy access! This goes through the learning objectives for each of the modules and also provides ideas of activities you can have your child do to further cement the concepts they learned.

The fact that MoneyTime Financial Literacy is an online program may not be a benefit for everyone, but for me and my kids it definitely is. My kids, like most kids, enjoy screen time, and since it is interactive, they aren't as likely to wander to other sites. The online format means you don't have to grade anything. It allows the kids to complete the student modules independently.

Being online also helps it fit into your schedule since you can use it on mobile devices. But the main reason it fits into schedules easily is the fact that each module only takes about 20 minutes to complete, and if your child completes 3 a week they will finish in about 3 months. You can easily speed it up or slow it down to fit the time you have available.

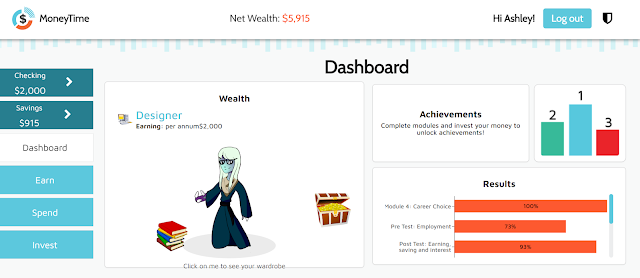

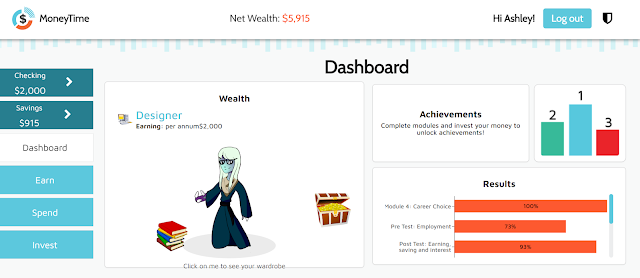

The biggest reason

MoneyTime Financial Literacy Program works for my kids is its game format. Kids complete tasks to earn money including quizzes over the material they are presented. Kids can use this money to purchase things for their avatar, to invest, or to donate. There is a leader board you can get on if you have accumulated the most wealth, and there are medals to earn for generosity in donating (since that takes away your wealth).

One other thing I really like about the MoneyTime Financial Literacy Program was the fact that the modules ask kids to input specific answers, so the program is more applicable to the student. In the earning money module it asks for 2 kinds of jobs the kids would be interested in doing to earn money and then in the second module it asks them to name something they want to save for. Then the modules will specifically mention those things. This makes the concepts a lot more realistic then reading about saving for X things while making $Y at Z job. It lets student really see themselves in the program.

Areas that could be Improved in MoneyTime

- Ability to have more than one student per email account

- More information given on retirement plans

I didn't find a whole lot not to like about the

MoneyTime Financial Literacy Program. It goes way beyond what I would have imagined teaching my preteen and early teen. That being said, I would really like to be able to have individual students under the same email address. I understand having the option to have it separated for kids in school using individual emails, but for homeschoolers, a family account with individual students would make life easier when logging in kids that can't keep passwords straight! This may be an option for the family subscription in which case, I should have done that!

The second thing I noticed was that there was not a lot of information provided on retirement plans. While this may not be a concern for most kids, I literally passed up on starting a 401K at my job when I was 17-years-old because I didn't see what benefit it would be for me when I was about to go to college and needed money for that. In hind sight I should have taken that because the little money I would have missed out on would have multiplied!

More Reasons to Try MoneyTime Financial Literacy

Money Back Guarantee

Yep, you read that right; MoneyTime offers a 60 money back guarantee, so you can try the program risk free. If you aren't happy with it; get a refund!

Family Subscription Packages

Currently, MoneyTime offers 3 subscription packages: for 1 child, 2 children, or 3-5 children. You can also contact them at infor@moneytimekids.com for subscriptions for more than 5 children. They are happy to work with homeschoolers!

Discount

Right now you can get 25% off any order using the coupon code HSCHOOL20 at checkout. This will apply to single and family subscriptions.

So what are you waiting for? Head to

MoneyTime now to start teaching your kids about managing money!

Enter to Win a MoneyTime Subscription

Now you have the chance to enter to win 1 of 10 subscriptions to MoneyTime! Enter below.

.jpg)

.jpg)